Itr

List itr

-

We provide 0% processing charges for itr filing in indiaqr code link to this post with free itr filing in india, simplify tax offers the best itr filing services all over india by the experienced ca professionalsfor more details call: +91- show contact info or visit https://www

-

Here we will tell you how you can file the various categories of the itr formif you wish to file your income tax return, you must know how to file the itr form

-

itr filing in india is now made more user friendly because the entire process being digitized and it can be made more economical process if you file free itr efiling in india through simplify taxin/income-tax-return-filingfor more detail call: +91 show contact info or visit https://wwwqr code link to this post simplify tax is providing free online income tax return efiling in india by our expert consultant

-

Our plans involve salary & income, itr 2 form house property, capital gains & others, gst filing, gst efiling, gst registration, gst returnqr code link to this post itr-2 form is a very important form to file the income tax returns by indian citizens and non- residential citizens with the income tax department itr 2 form e-filing tax services and plans for income tax return online with us at trutax

-

Get your itr filed starting at just rs. 500. call on

-

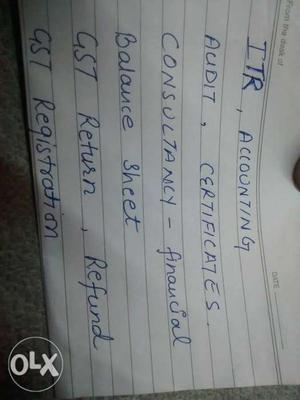

We provide below services itr income tax return accounting audit certificates balance sheet gst returns gst registration gst refund

₹ 500

-

Our team understand your earnings and files the returns taking into account all rules and applicabilitysimplify tax easy to use comparison to another sitein/income-tax-return-filingqr code link to this post file free income tax return (itr) efiling online in india of 0% processing fee with simplify taxfor more info call: +91 show contact info visit https://www

-

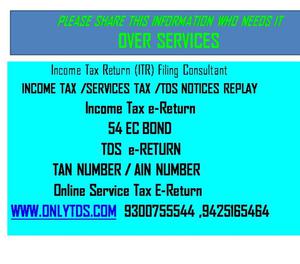

Qr code link to this post we provide itr services at just rs354/- income tax services applying pan / tan e-filing of income tax returns online payment of income tax / tds tax planning and tds refund post filing issues, scrutiny cases and it notice compliance filing of tds / tcs returns and issue of form 16 or 16a quarterly tds returns filing balance sheet and p&l statement it return filing with computation ca certified it return filing ca certified it return filing with balance sheet it return filing for co-op society

-

itr 499/- 1999/-, onlytds dot com house nor block naveen shahdara beside vikas cine mall gali no 1 in front of shahdra metro station (red line) north east delhi 110032 mo

Lalbahadur Nagar (Andhra Pradesh)

-

Gst filling itr and tds filling and registration it tax solutions company provides best service to filling your return and gst file ot tds filing for more information conc shekhar gupta 9333007555-44

India

-

Apne business ki gst and trademark itr file karvaye sabhi type business ki seva call kare

-

Vp associate tax registration

• gst registration

• professional tax registration

• tan registration

• pan registration

tax filing

• income tax return filing

• itr filing for doctors

• gst return filing

wwwChennai (Tamil Nadu)

-

ऐसे में इसके लिए भी itr फाइल होना जरूरी हैitr भरा होने से आपके लिए लोन लेना भी आसान हो जाता हैहालांकि टीडीएस रिफंड हासिल करने के लिए जरूरी है कि आपने itr फाइल किया होदरअसल ज्यादातर बैंक ऐसे वक्त पर आपके itr की जानकारी आय के स्रोत की जानकारी पुख्ता करने के लिए मांगते हैंलोन लेना होगा आसान:आप लोन लेने की तैयारी कर रहे हैं, तो itr आपके लिए इसे हासिल करना आसान बना सकता हैtds क्लेम करने में मददगार: टैक्स के दायरे में नहीं आने के बावजूद itr भरने का फायदा यह मिलता है कि आप आसानी से tds क्लेम कर सकते हैंविदेश जाना है तो: आप विदेश जाना चाहते हैं और वीजा के लिए अप्लाई कर रहे हैं, तो कई देश आपको वीजा देने से पहले आपके itr की जानकारी मांगते हैंनहीं आते हैं टैक्स के दायरे में तो भी भरें itr, मिलेंगे ये लाख रुपये से कम है, तो आपको itr भरना अनिवार्य नहीं है, लेकिन आपके पास हमेशा जीरो आईटीआर भरने का विकल्प रहता हैशेयर बाजार में निवेश: आप शेयर बाजार में निवेश करते हैं और आपको पूंजीगत घाटा होता है, तो आप इसे कैरी फॉरवर्ड कर सकते हैंअगर आपके बैंक ने 10 हजार रुपये से ज्यादा के ब्याज पर टीडीएस काटा है, तो आप रिफंड ले सकते हैंदूसरी तरफ, अगर आपको मिलने वाला घर का किराया सालाना स्तर पर 18 लाख रुपये से ज्यादा है, तो इस पर टीडीएस कटता हैइसका मतलब यह है कि आपका टैक्स तो नहीं कटता, लेकिन आप सरकार को अपनी आय की जानकारी देते होइसके जरिये वह आपकी वित्तीय स्थिति जानने की कोशिश करते हैं और उसके बाद ही आपको वीजा देते हैंहालांकि इसके लिए जरूरी है कि आपका आईटीआर भरा हो

₹ 500

-

We provide income tax e return filing and tds refund income tax e filing itr filing

-

itr (return file) firm registration, company incorporation, food license, shop act license, vat/tin, import export code

-

itr, food license, shop act license, firm registration, company registration, trademark

-

Pan card, gst, itr(return file), shop act license, food license, dsc, import export code, company registration

-

Pure silver perfume or either bottlewhich weights 46! an antique pieceat the best price

₹ 4999

-

Cotton digital printed salwar kameez catalog from sahiba itrana aliyah at wholesale fabric - pure cotton digital print with embroidery bottom pure cotton duppatta - chiffon /cotton digital print exact fabric details see list

₹ 1300

-

Tax consultants for income tax returns e-filing or it returns we provide the following services gst filing, income tax consultants or itr filingincome tax returns for senior citizens, salary,rental,bank interest etc at reasonable costyou may reach on nine nine four one,six seven seven,six six nine

₹ 1250

-

Gst registration in rs499 (offer valid in june ) trademark in 999/- govt fees additional at actual

-

This is how salaried individuals can use itr-1 to e-file their itr onlineitr-1 sahaj form is an income tax form for salaried individuals

-

Complete guide for goods and services tax at all india itrintroduction to gst, filing gst returns, applicable gst rates and gst registration all at one place

-

Income tax, itr online, income tax refund, efiling income taxget a basic understanding of capital gains, its importance, the way it is taxed and how you can use them to save taxes

-

The last date to file income ta return has extended from 31st july to 31st august , here is what you need to know about filing your itr for the previous years

-

We provide you compliance rules for appointing directors, presenting board reports, statutory registers update, and annual e filing for roc

-

Learn more about the tax benefits provided to sebior citizens by the government with all india itrwhat tax saving benefits does our government provide to its senior citizens

-

Guidelines for e-filing of income tax returnincome tax returns (itr) efiling - here is a step by step guide that will help you with e-filing of income tax return