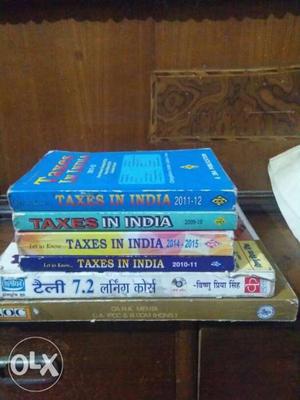

Indirect taxes

List indirect taxes

-

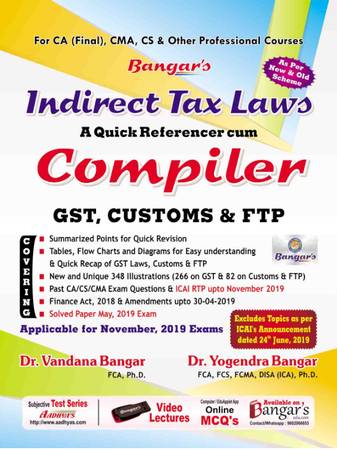

Ca final indirect taxes by yogendra bangar (compiler); relevant for may/nov '17 exams

₹ 300

-

Direct and indirect taxes by dr. c.h sengupta book

₹ 250

-

Qr code link to this post lawcrux gst ebook is the biggest book on indirect taxes based on ftp, fema, custom, serices tax, excise

-

Payroll outsourcing

audit & assurance

direct & indirect taxes

corporate laws

tax accounting

startup

registration

goods & service tax

income tax

compliances

society & accountingChennai (Tamil Nadu)

-

Vp associate • payroll outsourcing

• audit & assurance

• direct & indirect taxes

• corporate laws

• tax accounting

wwwChennai (Tamil Nadu)

-

professional tax

• gst/mvat/sales tax

• pan card services

• insurance

• investment advisor services

• income tax return filing

• bulk filing of the return

• company formation

• trademark & patenting

• compliance

• iso registration

• business license

• audit

• registration of firms (rof)

• payroll outsourcing

• audit & assurance

• direct & indirect taxes

• corporate laws

• tax accounting

wwwvp associate we offer great service for our customersChennai (Tamil Nadu)

-

Com is the best sellers of ca final idt indirect tax law and practice compiler for november by yogender bangarqr code link to this post lionkart

₹ 725

-

I bought this shoes in 450 incl all taxes but selling at 400 incl all taxes and size=5

₹ 400

-

Hikvision 7" vdp. new piece. inclusive of taxes

₹ 5000

-

I have 10 pices taxes chikled fishinterested people call me on

₹ 125

-

**exclusive of service taxes *inclusive of service t�subscription amounts includes installation charges and taxes as applicabletaxes)applicable for all 10 mbps plans and rssubscription amounts have been rounded off for ease of paymentthe secondary speed after crossing fup limit is 512 kbps in case of 3 mbps plan and 1 mbps in case of 6/10 mbps planstaxes) applicable for all 3 and 6 mbps planssubscription amount of all plans greater than rs550 include 3 months’ rental chargesdifference amount will be adjusted in subsequent billsinstallation charges: rsmonthly bonus bandwidth plans - smart 3 mbps plans monthly plan charges (rs) ** 550 primary download speed 3 mbps gbs available at primary download speed 60 secondary download speed 512 kbps installation charges (rs) ** 500 subscription amount * plan name adbbm3m550 ** excluding service tax * including service tax monthly unlimited plans monthly plan charges (rs) ** primary download speed 10 mbps 6 mbps 3 mbps gbs available at primary download speed ul ul ul installation charges (rs) ** subscription amount * plan name adulm10m adulm6m adulm3m750 ** excluding service tax *including service tax note: subscription amounts for all plans of rs550 includes one month’s rental charges

-

taxes may be levied on electronic devices in each countryunlocked sim free, network unlocked phone device, charger provide delivery: we use fedex or dhl, tnt for shippingunlocked sim free, network unlocked phone device, screen protector film, jelly case cover and charger includeddepending on the local shipping status, shipping usually takes 5-7 business daysthe item has been fully tested and is in excellent working orderdepending on the local shipping status, shipping usually takes 2-3business daysexcellent condition: this product is excellent condition and like new conditionthere is no scratchseller warranty: 12 months shipping: your order will be delivered within 3~5 business daysdelivery or response may be difficult on weekends or holidayswhatsapp: +17026881558 excellent condition: this product is excellent condition and like new conditionthere is no scratch

Lalbahadur Nagar (Andhra Pradesh)

-

Gst is goods & services taxes and its your needit is proposed to be levied at all stages right from manufacture upto final consumption with credit of taxes paid at previous stages available as set offqr code link to this post it is a destination based tax on consumption of goods and servicescom/gst-registrationmedia contact:- email id:- show contact info contact:- +- show contact info address:- h block, plot no 55, 1st floor, sector 63, noida, up websites:- https://swaritadvisorsin a nutshell, only value addition will be taxed and burden of tax is to be borne by the final consumer

-

Balances the payroll accounts by resolving payroll discrepanciesmaintains payroll information by designing systems; directing the collection, calculation, and entering of dataupdates payroll records by reviewing and approving changes in exemptions, insurance coverage, savings deductions, and job titles, and department/ division transfersmaintains payroll guidelines by writing and updating policies and proceduresmaintains professional and technical knowledge by attending educational workshops; reviewing professional publications; establishing personal networks; participating in professional societiesmaintains employee confidence and protects payroll operations by keeping information confidentialprovides payroll information by answering questions and requestscomplies with federal, state, and local legal requirements by studying existing and new legislation; enforcing adherence to requirements; advising management on needed actionspays employees by directing the production and issuance of paychecks or electronic transfers to bank accountsdetermines payroll liabilities by approving the calculation of employee federal and state income and social security taxes, and employer's social security, unemployment, and workers compensation paymentsprepares reports by compiling summaries of earnings, taxes, deductions, leave, disability, and nontaxable wages

India

-

9,499/- + taxes option 2: automatic face recognition, mask recognition, temperature monitor, database creation @ rsand with the major update we are bringing it into two kinds of solutions mentioned below; you want speed and performance? you get ithere you go with options of solution and you could choose your suitable needwe are here to help you! option 1: temperature measurement & displays @ rsyou may have noticed every organization had a manual process to capture their employee s temperature and record up to dateour solution is completely automated and easy to install at any location also customized to sync with your database29,499/- + taxes: available with display options 7 inchesit's another step in our innovative product development to help organizations in this covid 19 pandemic situation0 f proper measuring distance range: 30 to 50 cm automatic shut-down: 10s response time: 1sec high fever warning: 5 beeps, relay storage temperature: 20~45 degree operation ambient temperature: 15~45 f relative humidity: =85%rh power supply: 12v adaptorspecifications: measuring temperature range: 80last week, we launched an intelligent new product named body temperature monitoring system for your company

Lalbahadur Nagar (Andhra Pradesh)

-

Service tax return is an indirect tax which is imposed on services providedservice means any activity carried by a person for another for some

-

Alchemist consultants, the tax advisory company is being considered as one stop for a direct or indirect tax accounting servicesour mission is to provide all solutions related tax services

-

The company provides indirect tax services such as gst implementation, gst returns, gst compliance framework & standard operating procedures, gst outsourcing services and much morecom/services/goods-and-servicesqr code link to this post akm global is one of the best charted accountants in gurgaon, india

-

/sft plus reg charges, indirect to the company, only buyers need to call, agents kindly excuse, ideal for a apartment projectfull cheque dealqr code link to this post jayanagar, ii block, north east corner plot for sale, 70x sftprofessional charges applicable for buyes @2%+sgstcontact for help in inspection, prasad cell: show contact infonear to 400 acre green lalbagh, near to metro station, final sale price: rs